Welcome to a Brighter Financial Future

Our expert guidance is rooted in understanding and empathy, recognizing that each financial journey is unique. We’re committed to empowering you with knowledge, tools, and strategies that make a real difference. Together, let’s transform your financial challenges into opportunities for growth and success.

Choose Your Path to Success

Debt Management

Overwhelmed by debt? We provide proven strategies to help you reduce and manage your debt, from the snowball method to personalized repayment plans.

Budgeting Made

Simple

Learn how to create a budget that works for you, not against you. We offer easy-to-follow guides and templates to help you track your spending and save more.

Family Financial Planning

Discover ways to involve your whole family in budgeting, saving, and setting financial goals.

Investing for the Future

Whether you’re a beginner or looking to expand your portfolio, our investment guides and tips will help you make informed decisions for a secure future.

15k+ clients worldwide turn to us

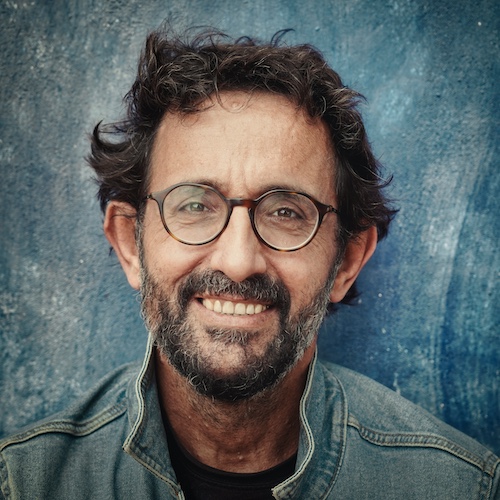

About us

Your Financial Transformation Partners

Founded by a team of passionate financial experts, we’ve experienced firsthand the challenges and triumphs of managing money. Our diverse backgrounds in finance, education, and counseling equip us with a unique perspective on the varied financial landscapes that individuals navigate.

15k+ clients

Worldwide

Success Stories

Real Results in Debt Management

Celebrating remarkable victories in debt reduction, our clients have collectively paid off millions in debt.

Years of experience

Average Debt Reduction

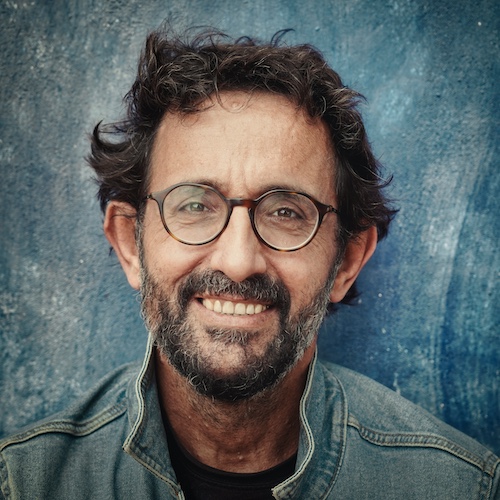

Some Love From Our Clients

“I was overwhelmed with credit card debt and student loans. Their personalized approach and practical advice helped me develop a solid plan to tackle my debts. In just one year, I’ve paid off 40% of my credit card debt and feel more in control of my finances than ever before. This journey has been life-changing! ”

Gina P.

“I never thought I could get out of the debt cycle, but these guys proved me wrong. Their budgeting tools and debt management strategies were exactly what I needed. I’ve successfully paid off all my high-interest debts and have even started an emergency fund. I’m forever grateful for their support and guidance. ”

Mark R.

“As a recent graduate, the weight of my student loans felt crushing. The experts at HFW helped me navigate repayment options and set realistic financial goals. Two years later, I’ve managed to reduce my student loan debt by over 50%, and I’m on track to be debt-free much sooner than I ever imagined. Thank you for giving me a fresh financial start!””

Alisha K.

15+ Partners Worldwide

Have A Price For Every Plan Out There

It’s always wise to add information in chunks. That way your website users will find it easier to digest content on your site.

$0

Free

Financial Foundations

Access to Basic Financial Wellness Content: Select articles, blog posts, and videos.

Introductory Financial Wellness Quiz: Basic assessment to gauge financial health.

Monthly Newsletter: Tips on budgeting, credit repair, and debt management.

$9

Standard

Smart Money Manager

All Free Tier Features

Extended Financial Education Resources: In-depth guides, webinars, and expert talks.

Credit Repair Guides and Checklists: Detailed steps for credit improvement.

Personalized Budgeting Tools: Access to budget calculators and planning tools.

Priority Email Support: Faster responses and personalized financial tips.

$29

Premium

Wealth Builder

All Standard Tier Features

Exclusive Financial Analysis and Review Sessions: Identify opportunities for improvement, and strategic.

Advanced Investment and Savings Strategies: Guides and tools for long-term wealth building.

Custom Financial Planning: Tailored financial plans to meet specific goals.

Exclusive Webinars and Events: Access to premium events and expert sessions.

Here are some frequently asked questions

What is the most effective strategy for paying off debt?

One popular method is the “debt snowball” strategy, where you focus on paying off your smallest debts first while making minimum payments on larger ones. This can provide psychological wins and build momentum. Another method is the “debt avalanche,” where you pay off debts with the highest interest rates first to save money on interest over time. You can learn more by clicking the links above!

Is consolidating my debt a good idea?

Debt consolidation can be beneficial if it lowers your interest rate, simplifies your payments, or helps you pay off debt faster. However, it’s important to ensure that the consolidated loan doesn’t just extend your debt period without significant benefits.

How can I manage my student loan debt effectively?

To manage student loan debt, consider options like income-driven repayment plans, refinancing for a lower interest rate, or exploring forgiveness programs if you qualify. Always ensure to make at least the minimum payments and stay informed about any changes in student loan policies.

Can budgeting help reduce my debt?

Yes, creating a budget is a crucial step in debt reduction. It helps you track your spending, identify areas where you can cut costs, and allocate more money towards paying off your debt.

How does debt affect my credit score?

High levels of debt, especially credit card debt, can negatively impact your credit score. Missed or late payments also harm your score. Conversely, making consistent, on-time payments can improve your credit health.

Dive In

Articles

-

Take Control of Your Money: Easy Steps to a Better Financial Future

Learn how to budget, reduce debt, and achieve financial freedom in this empowering guide.